Intro

Choosing between XM and AvaTrade as your online trading platform is not easy as both comes with their own highpoints and very few drawbacks. Despite the many Pros of these online brokerages, it is important to select the one that will vibe perfectly with your trading style.

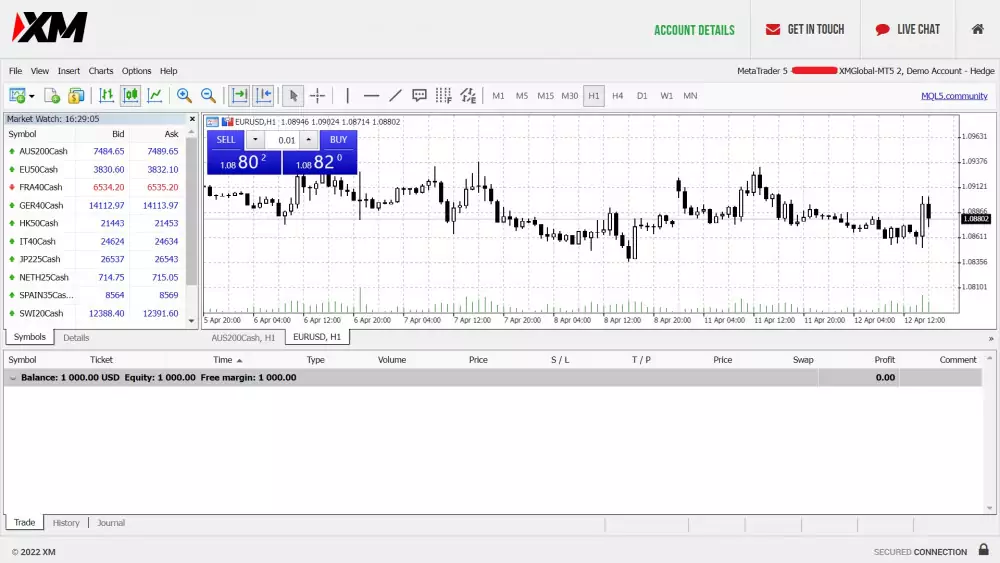

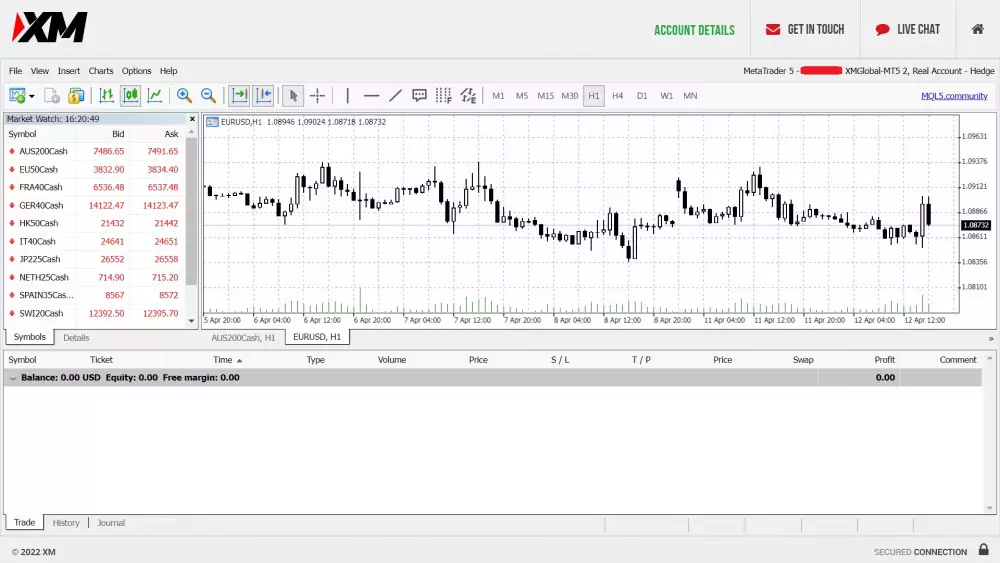

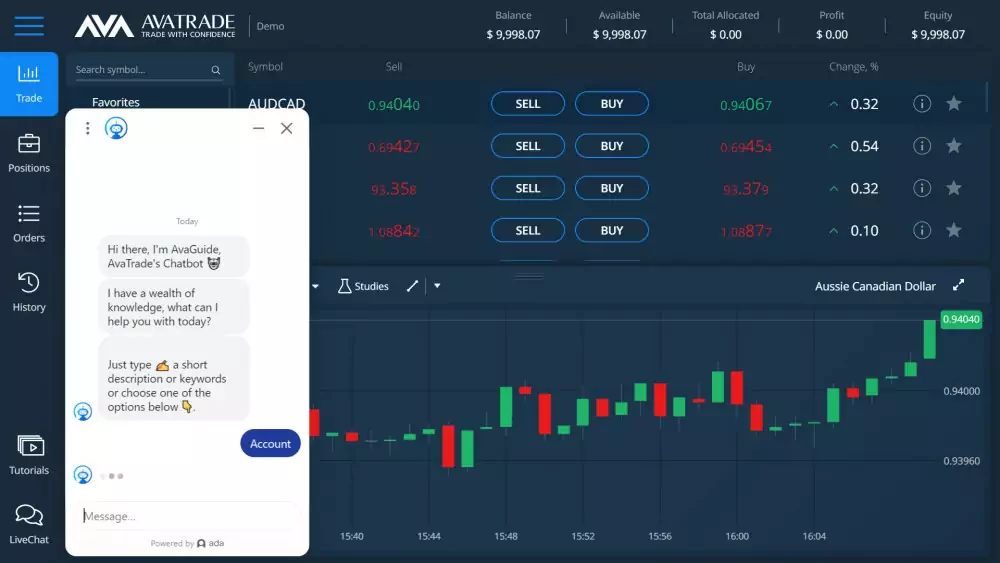

You can easily learn the ropes of online trading without investing and risking real money through a demo account feature available in many online brokerages. Good thing, both XM and AvaTrade offers a demo account for every trader — both experienced and beginner — that gives them the opportunity to finetune their trading strategies as well as explore and familiarize with the interface of each online trading platforms.

Just remember that both trading platforms’ Demo Account features comes with an expiry date. So, it is best for any user to maximize their use of the demo account before it lapses. Take note that AvaTrade expires after 3 weeks while XM’s demo account expires a little longer at 90 days.

Here’s the thing:

One must use a Demo Account as if an entire investment depends on it. Treat the virtual money on your demo account as if it’s your real money so you will be motivated to strategize and plan your investment better. By doing this, you help brush up your trading skills without losing any money. The trading skills you will achieve by maximizing the use of a demo account will help you better understand the movement of the market and give you a deeper knowledge about trading and gain you much-needed confidence when you finally start trading using real money.

“Practice makes perfect”, as the saying goes. In online trading, this saying can be loosely translated into “demo account practice makes a trader rich”

The XM trading platform offers users 4 different account types to choose from. These are the following:

Unlike XM, AvaTrade does not offer any account classification. When you sign up for an account, expect it to be your type of account forever — or until AvaTrade make some changes.

In comparison with other online trading platforms like eToro, both XM and AvaTrade do not offer exclusive membership accounts.

Take note: Both XM and AvaTrade offer Islamic Accounts that follow the guidelines of the Islamic Sharia Law.

For every online trader's peace of mind, it is worth noting that both AvaTrade and XM are heavily regulated by global regulating and financial authorities that includes the Australian Securities and Investment Commission (ASIC), the Financial Services Commission (IFSC), Financial Stability Board (FSB) and more. On top of this, both trading platforms also have top-tier licenses — 2 for XM and 6 for AvaTrade.

AvaTrade has licenses from the following financial regulators:

XM Group on the other hand has a license from the following:

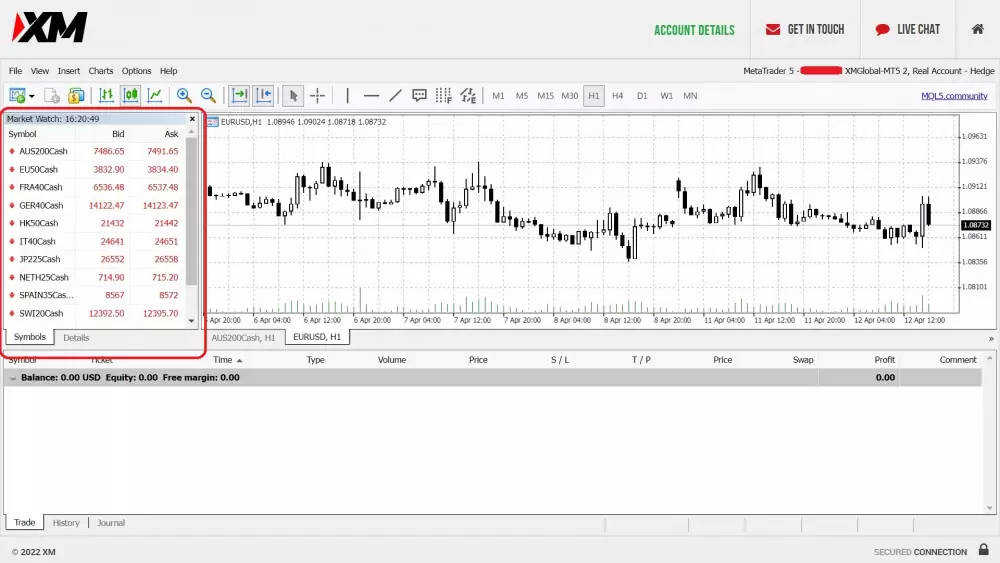

Both XM and AvaTrade can be used using the three main platforms of Web, Mobile and Desktop.

AvaTrade is available on these platforms:

XM meanwhile, can be accessed on the following platforms:

Remember: Since XM pioneered the MT4 and MT5 technology, many MetaTrader users are more comfortable in using XM as their main online trading platform.

When it comes to assets tradeable in both platforms, AvaTrade gains some advantage since it allows CFD trading on stocks, as well as ETFs, indices, cryptocurrencies, options, bonds and commodities.

In comparison, XM only have CFDs on stocks, indices, commodities and currencies as its available assets.

XM has more than 1370 tradable symbols while AvaTrade totals around 1260.

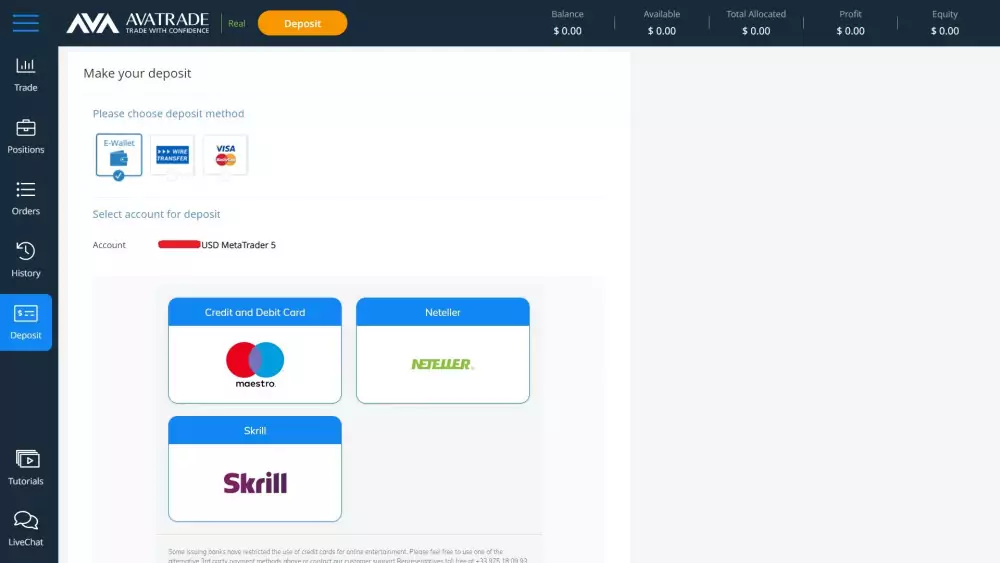

AvaTrade requires a $100 deposit while XM only asks users for a $5 deposit.

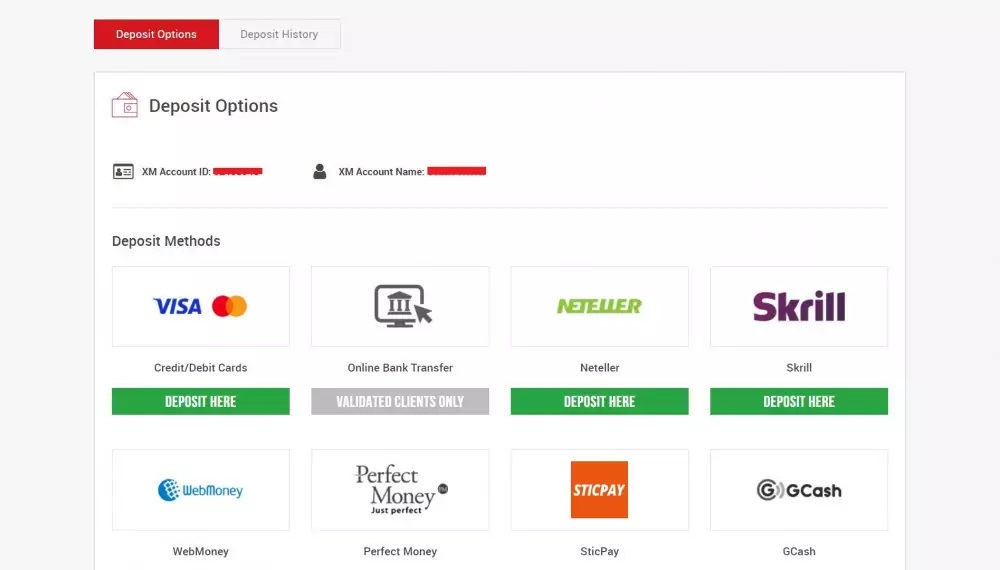

AvaTrade accepts deposits via Bank wire, Visa or Mastercard Debit and Credit card, PayPal and Skrill.

XM also accepts deposits from the same list as AvaTrade with the exception of PayPal.

For a newbie trader short on cash, XM might appear more of a fit because of its low deposit prerequisite.

AvaTrade fares behind XM when it comes to withdrawal process time since it may take a minimum of two business days before withdrawal is processed. Wherein XM’s case, any withdrawal requests only takes less than 24 hours.

The good news: Both trading platforms charges ZERO withdrawal fees.

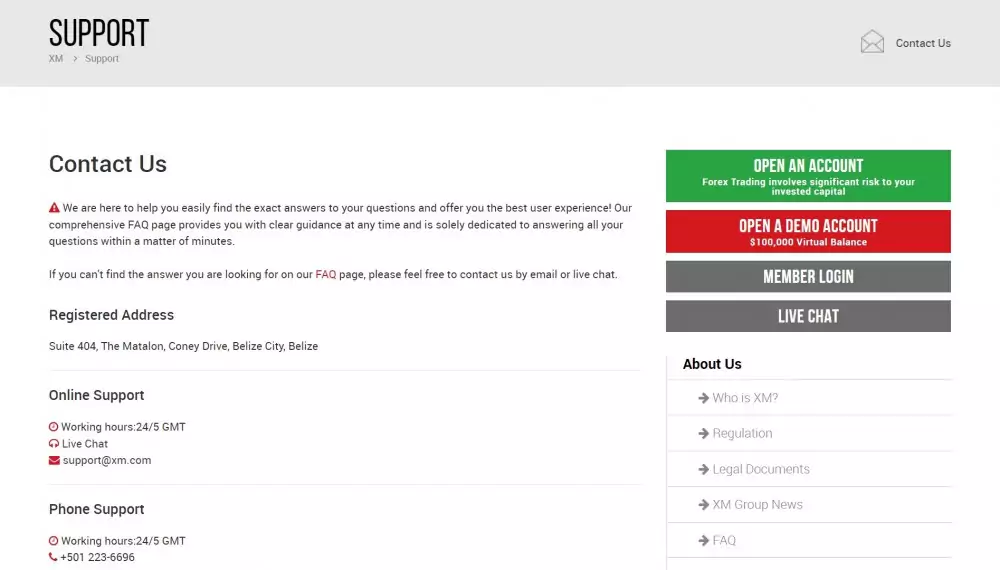

AvaTrade takes a slight edge in customer service courtesy of its faster customer support. The two trading platforms however have excellent customer service that includes chat support, email support and phone support.

Remember: A live chat support provides replies in real-time while an ordinary replies from an ordinary chat support may take from a few to several minutes to arrive.

Despite a very close head-to-head comparison, XM enjoys a slight advantage over AvaTrade according to most experienced traders — thanks to the robust features of the XM trading platform. When looking at the other categories such as financial assets available, research tools, copy trading tools and educational guide to traders, both AvaTrade and XM almost cancels each other by having almost the same features offered to users but by basing it on the scores, AvaTrade is the winner.