Would you want to participate in trading crude oil but are still clueless on how to start?

Do not hesitate for another second, and continue reading this as this will definitely give you the headstart in the world of commodities trading.

Prior to trading crude oil, it would be for you to see be aware of these significant statistics and figures.

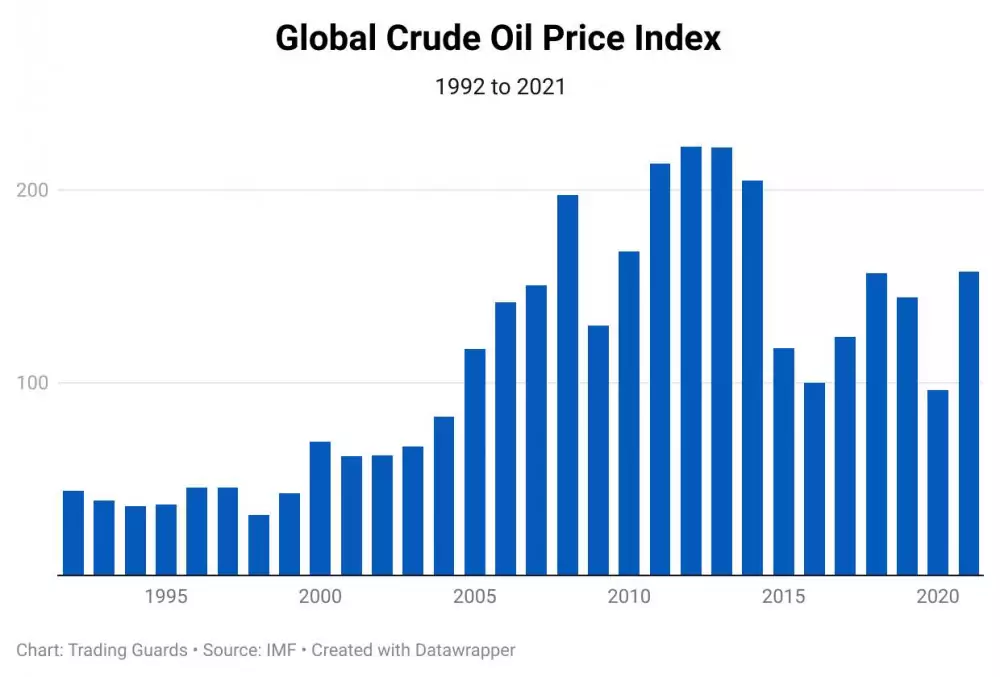

The crude oil price index worldwide has always been very volatile. It 1992, the index was at 43.76 and it reached a peak of 222.45 in 2012. In 2021, the index was at 157.46. Benchmark prices including Brent, WTI, and Dubai Fateh are the basis for this index.

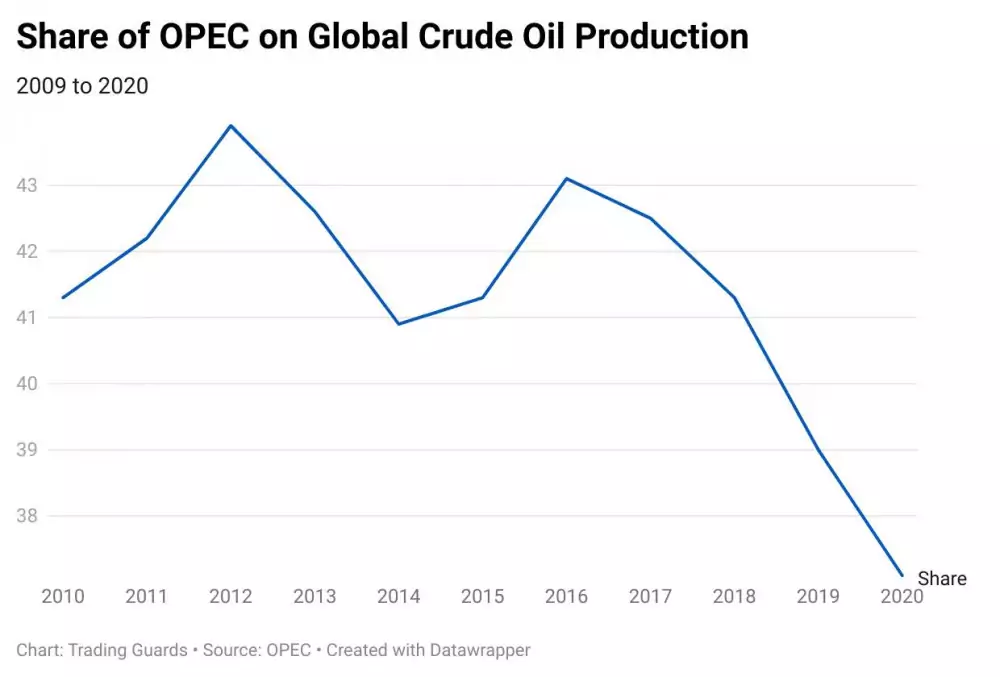

OPEC's share of total global crude oil production has decreased from 41.30% in 2009 to 37.10% in 2020.

The USA is currently the world's largest oil producer. It was in 2018 when it was able to surpass Saudi Arabia which used to hold the top position for more than two decades.

While there are 32 US states that produce this precious commodity, Texas, North Dakota, New Mexico, Oklahoma, and Colorado are the biggest oil contributors covering 71% of the country's total production.

| Country | Production (barrels per day) |

|---|---|

| USA | 18.87 million |

| Saudi Arabia | 12 million |

| Russia | 11.3 million |

| Canada | 5.85 million |

| China | 4.99 million |

For starters…

Commodities are in most cases, raw materials which are being traded in the marketplace. They are often used as materials to create further end-products in the form of other goods and services.

Since these materials are being traded in the marketplace, their prices tend to fluctuate based on the supply-demand dynamics and/or changes in sentiment.

The dynamics is as follows:

If there's an increase in demand, but the supply doesn't change or decreases, then buyers are willing to purchase that material even at higher prices; thus making the price of crude oil higher.

On the other hand…

If there's an increase in supply, but the demand does not change or decreases, then those who have that material are willing sellers even at lower prices; thus making the crude oil prices go lower.

These commodities are commonly traded as spot contracts (immediate exchanges upon settlement) or as future contracts (prices are specified for delivery of a particular quantity at a later date), and they are being traded on exchanges.

Commodities exchanges enforce the procedures and rules of how market participants trade these standardized contracts and their relevant investment products (for example CFDs, derivatives, options, etc.).

Crude oil is a type of fossil fuel which can be processed to create end products such as diesel, gasoline, and other petrochemical variations.

Due to the wide usage of this non-renewable resource (a limited resource), it is one of the most actively traded commodities in the world.

Because of it being traded by plenty of traders, this creates ample volatility for participants to be able to profit from it regardless of the general direction.

Traders and investors could participate in the market movements by buying and selling either spot contracts, wherein the spot contract's price reflects the current market price of crude oil; or futures, wherein, the contract's price represents the price wherein the buyers are willing to pay for that crude oil contract on a delivery date that is set at some future date.

Take note though:

Futures contract's price is NOT a guarantee that crude oil will be able to reach that price upon the agreed-upon date, but is used instead as a hedge (to manage risk), or as a way to speculate what the direction of the prices will be in the future.

Aside from buying and selling spot and futures contracts, traders and investors could also participate in trading derivative instruments of crude oil.

These financial instruments are derived from individual assets (in this case, crude oil). These are also contracts, between buyers and sellers, whose prices are to be valued based on the acknowledged underlying product.

Contracts for Differences, or CFDs, are examples of derivatives. It is a process wherein the settlement of the opening and closing prices are being settled in cash. It is an agreement to have the difference in valuation exchanged between the price of the contract when it was opened and the subsequent contract's price when it was closed.

CFDs can also be advantageous to traders because they can profit regardless of the market's direction. They can go long if they think that the crude oil prices will go up, or go short if they think that crude oil prices will go down in value.

Did that CFD introduction catch your interest?

Trading CFDs is fairly easy to do. Once you have already logged in to the platform of the broker of your choice, the trading screen has all the components needed to facilitate trading.

Trading-related information tends to be located in the same screen and you just select crude oil from the list of tradable instruments.

Then using the charts, analyze which direction the price likely will go to, then proceed to go long or short, basing from your analysis. Then manage the trade by taking profits, protecting your gains, or cutting your losses if the trade goes against you.

These brokers listed here offer the best features, the most competitive price spreads, and of course, platform stability.

For macroeconomic matters, they also show the latest market news and financial calendars in order for you to be updated and be guided on your decision-making processes.

These platforms also contain price charts if you're into technical analysis. They also have price alerts, so as for you to not miss important price movements even if you're away from your monitor.

And more importantly:

These brokers are regulated by different governing bodies located in different areas in the world.

Another form of derivatives is an option. Crude oil options are financial instruments that are based upon the price of this precious commodity.

An options contract enables the buyer to buy or sell the underlying asset (the action depends upon the type of contract they hold, namely: call or put options).

Call options enable the option owner to have the right, but not the obligation, to buy crude oil at a pre-determined price (called strike price) within a specified timeframe; whereas, put options enable the option owner to have the right, but not the obligation, to sell crude oil at a pre-determined price (called strike price) within a specified timeframe.

Option contracts will have an expiration date wherein the owner must exercise that option. If the speculator, through analysis, thinks that the price of crude oil will likely go down in the future, he may purchase put options instead of the actual asset, with the risk being the price that he paid for the options. Thus, it is also a form of risk management.

As an example:

Let us assume that on July 2019, a trader took a long call position on January 2020 crude oil options. The futures strike price is 50USD per barrel.

On October 1, 2019, the January 2020 futures price is 65 USD per barrel; the trader would then want to exercise his call options, by entering into a long January 2020 futures position at a price of 50 USD.

The trader may want to wait until expiration (January 2020) and accept the delivery at a locked-in price of 50 USD per barrel, or choose to close the position at a gain of 15USD per barrel (65-50 USD).

Hence:

The total profit would be multiplied by how many barrels which are included in contract that the trader has purchased.

There are also ETFs for this sector. But the available ETFs represent the oil-producing companies. ETFs could be used as a means of diversification.

Leverage is a strategy of employing borrowed capital to increase the return of your trade or investment.

The best part?

The advantage of using leverage is that one could trade a larger amount of contracts even with a smaller amount of capital – using the margin features of the broker to borrow the rest, which then could mean greater profits.

But most importantly…

Please do the necessary due diligence as well as leverage could work both ways:

It could enhance your gains, BUT it also could greatly increase your losses.

Trade outcomes are never guaranteed as the market dynamics continually change.

The constant interaction of buyers and sellers in the marketplace would make the movements erratic at times.

Why does this matter?

Thus, it is a good practice to have a process to adhere to, with guidelines and rules to follow.

Trading decision guidelines could roughly be categorized into two schools of thought:

For example:

If there are imbalances in the supply and demand, such as OPEC cutting down their supply, then crude oil prices are likely to shoot up in value.

Technical analysis, on the other hand, uses past data (prices and volume) to try and predict future price movements. The assumption in technical analysis is that all factors (macroeconomic, reasons not known to the public yet, etc.) are already reflected in the price.

Example is that of below:

The chart shown here is the weekly price chart of WTI Crude Oil. Weekly charts may be slower, but tend to have lesser noise in terms of price movements.

This is suited for market participants who have a longer-term point of view. Since early this year, the price is in a range of 50USD to around 63USD to 65USD.

It is currently approaching the area where there are more sellers than buyers (or the resistance zone). The support zone is where the buyers outnumber the sellers, hence producing more demand in order to drive the prices higher.

If you are a buyer at this stage, demand looks like it is still present as it pushes past 60USD, and there's still enough upside.

The 10-week moving average has crossed over the 20-week moving average indicating that demand has picked up over the shorter term and likely could still move the price upwards.

The stochastics indicator is nearing the overbought level, but is still pointing upwards.

However, do take note that it is approaching the resistance area, and it might prove to pay attention to that area and observe how prices react.

If the price looks like it is ranging, it might be a good process to buy when the price reacts positively to the support zone, and sell as it approaches the resistance zone, or if the price will react negatively if it reaches the resistance zone (the sellers pushing the prices down).

We can't emphasize enough…

Regardless of which school of thought to adhere to, be it fundamental analysis or technical analysis; it is always good to be reminded to always think in probabilities, as nothing is guaranteed.

And remember:

That these are merely guides, and we should always have risk management principles that we follow (cutting our losses, diversification, etc.).

Now that the individual components have been explained, let us go and see how all these components would add up in the exciting world of CFD trading.

Let us first define some terms that we might be encountering in analyzing price action data and in the trading execution.

With the introductions done, let us look at this example below:

Back in January 2019…

There were macroeconomic catalysts like the Venezuela (a known oil supplier) sanctions, and a drop on US fuel stockpiles.

These macroeconomic catalysts imply that the supply of oil in the world market has decreased.

Hence…

If the supply decreased and the demand remained the same or increased, then the prices will tend to rise.

Let us look at two different points:

If you looked at the chart in January (please refer to point A), the price is at the support zone (where we learned that it implies that there are many buyers at that price level). And if the buyers outnumber the sellers, then the price will tend to not go further lower, and likely will rise afterwards as more buyers will be enticed.

Then at point A, you see that the price is near the support zone and is now increasing, you then could go to your broker's platform and select CFD trading and look for crude oil from the list of instruments and buy (go long) that CFD. You could close that trade when the price has increased in value for a profit.

Are you still with us?

But if you are at point B and looked at the price at around late March or April 2019, the price is already near the support zone (where we learned that it implies that there are many sellers at that price level). And if the sellers outnumber the buyers, then the price will tend to not go further higher, and likely will decrease afterwards as more sellers will be enticed to also sell at lower prices.

Then at point B, you see that although the price is still increasing, but it already is nearing the resistance zone, you could then go to your broker's platform and select CFD trading and look for crude oil from the list of instruments and sell (go short) that CFD. You could close that trade when the price has decreased in value for a profit.

Please bear in mind:

You should still have risk management practices, like closing that trade even at a small loss, if the price action did not go according to your initial plan.

Trading CFD is fairly easy, right?

As you could just select crude oil from the broker's platform and select buy or sell as based on your analysis on the direction of crude oil's price.

So, what are you waiting for?

Sign-up now with any of these well-established brokers and grab the opportunity to learn and profit from crude oil price movements!