Intro

While both trading platforms have their own strengths, the two also comes with their own shortcomings. To learn more about these two online brokerages, we compare and examine what makes one unique from each other and also to help you which trading platform will suit your trading requirements and methods better. Let’s get it on and dig deep into the pros and cons of Plus500 and AvaTrade.

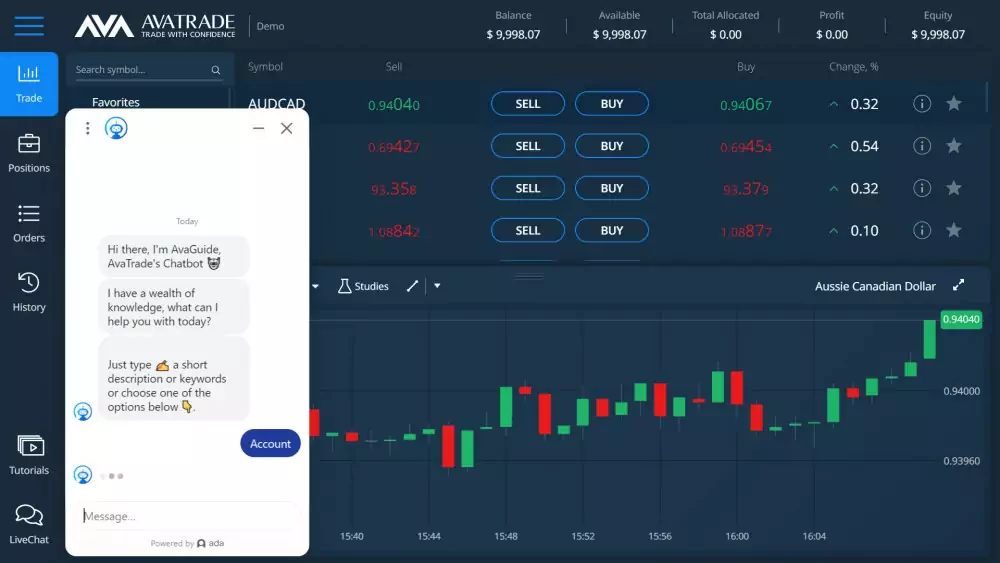

Good news for newbie traders and even seasoned ones who wanted to brush up on their trading skills. Both AvaTrade and Plus500 features a demo account which you can use to open and close trades in real-time and real-world market conditions using virtual money — therefore using it as a “practice” account without having to risk losing actual money on unsuccessful trades.

Plus500’s demo account doesn’t have any expiration date. This means you can use it as long as you like once you signed up for an account. In comparison, AvaTrade’s Demo Account expires after 3 weeks — consequently, you need to maximize using it until it expires.

Here’s the thing: A demo account gives you the chance to familiarize yourself not only with the interface and the features of a trading platform, but more importantly, it affords you the opportunity to learn more about trading by letting you get a feel of what its like to trade in the real world market without jeopardizing losing your money. Since, you are just starting your online trading journey, it is understandable for you to make losing trades and lose money. But with a “Demo Account”, you can learn from your mistakes without having to risk real money since you will be trading using a virtual money.

Look at demo account as a practice account, which you can use until you feel more confident about making trades using your money. Remember, “practice makes perfect”, and with a demo account, you have a chance at perfecting your trading strategies.

Unlike other online trading platforms like eToro and Pepperstone just to name a few, both Plus500 and AvaTrade doesn’t have any account classifications. Traders signing up for an account will all have the same account

Take note: AvaTrade and Plus500 both offers Islamic Account for Muslim traders. This account follows all existing guidelines set by the Islamic Sharia Law

Plus500 and AvaTrade are both regulated by renowned regulatory boards and financial authorities from all over the world. Traders would be glad to know that both trading platforms also have several top-tier and financial licenses (7 for AvaTrade and 6 for Plus500) allowing them to operate in the regions where both platforms are available.

Plus500 has a license from these top financial regulators:

On the other hand, AvaTrade has licenses from the following:

AvaTrade and Plus500 can be accessed through these following platforms:

For AvaTrade users, here are the available platforms:

The platforms for Plus500 are:

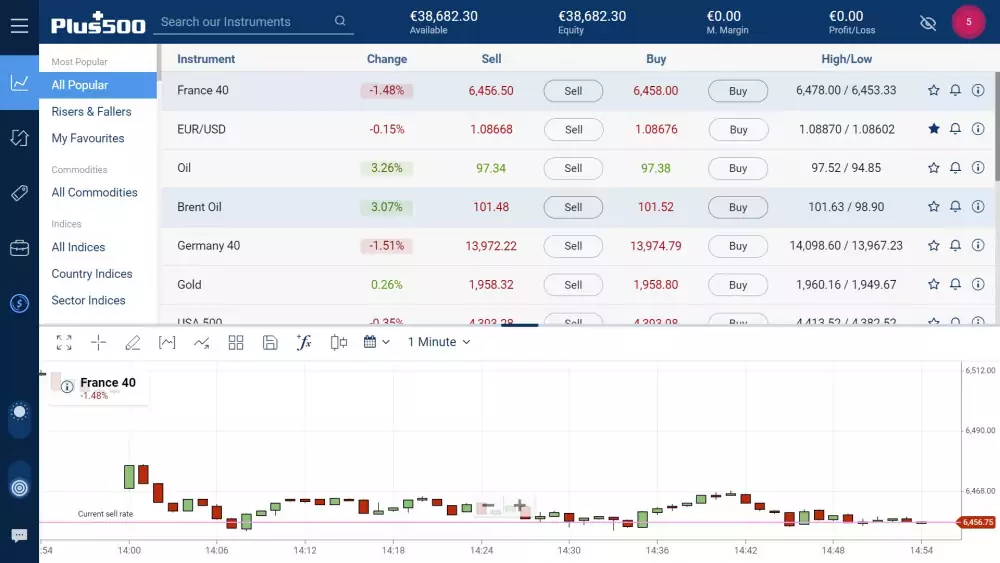

Financial assets available on AvaTrade include CFDs on stocks, ETDs, bonds, options, commodities, and cryptocurrencies.

AvaTrade has more than 600 stocks instruments, 59 ETFs, 55 Forex pairs, more than 20 Indices, almost 30 commodities, 14 cryptos available for trading.

Plus500 has more financial instruments than AvaTrade since it has over 1,700 stocks, 29 Indices, 71 Forex pairs, 22 commodities, almost a hundred ETFs and 14 cryptocurrencies (Availability subject to regulations - cryptocurrencies are not available to retail clients in the UK).

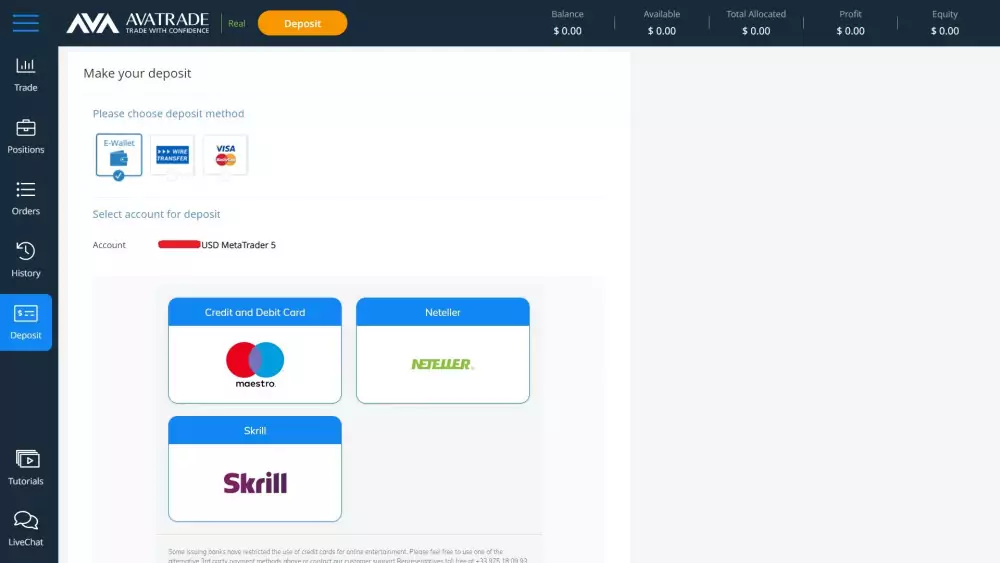

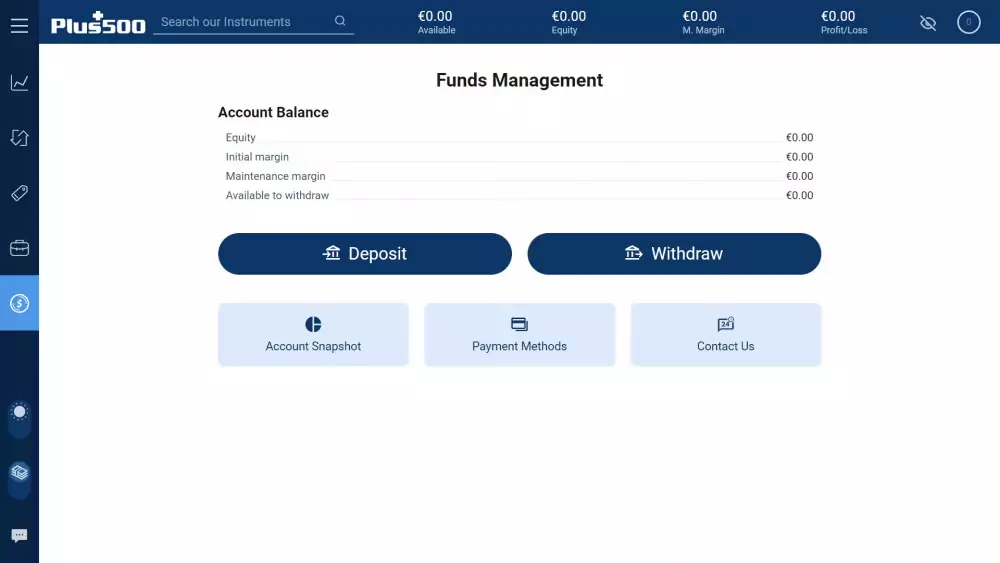

While both brokerages require a minimum deposit of $100, Plus500 comes with a slight caveat of requiring $500 when deposit is made via bank transfer.

Payment options for deposits for AvaTrade include bank transfers, debit or credit cards, PayPal, UnionPay, Neteller, WebMoney and Skrill.

Deposit payment channels for Plus500 are BPAY, credit or debit cards, iDEAL, PayPal, Bank or wire transfer, Giropay, Skrill and Sofort.

Withdrawal on both online trading platforms are done transacted through a Bank Wire, Visa or Mastercard debit and credit card, Skrill and PayPal. AvaTrade withdrawals takes 1 to 2 business days while Plus500 can take a little longer from 1 to 3 business days.

Traders who have used both trading platforms have attested to the stellar customer service of AvaTrade and Plus500.

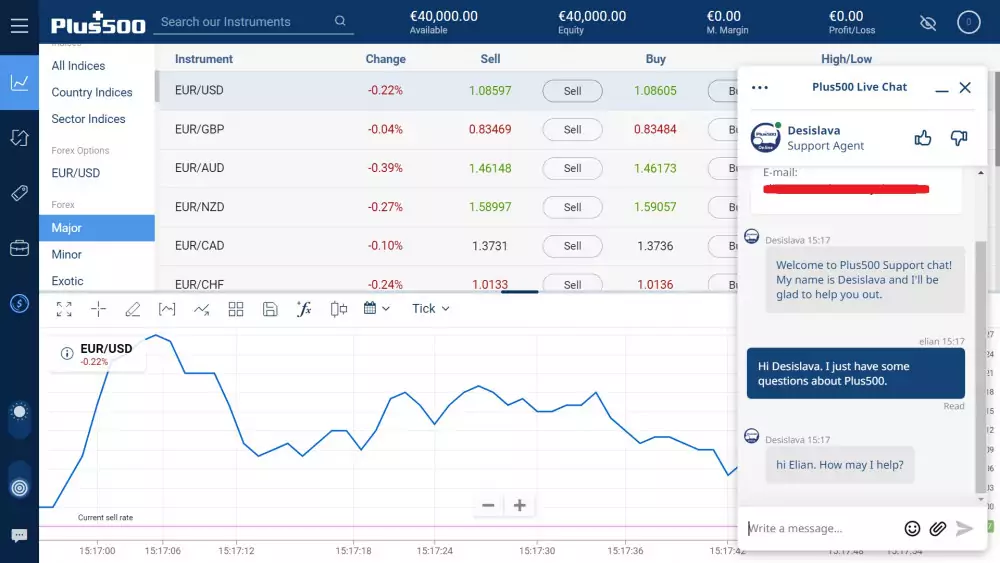

AvaTrade gains a slight advantage courtesy of its phone support which Plus500 do not currently have. However, whatever gain AvaTrade had, Plus500 is trying to compensate by having a WhatsApp support. The two have its own email and live chat / email support.

Both online trading platforms have solid strong points and very little cons. However, after considering the nitty-gritty details, AvaTrade comes out with the noticeable advantage due to its better interface that produces a greater user experience most especially for newbie traders. Plus500 may have a longer list of available CFD financial instruments but AvaTrade doesn't actually fall far behind given that it also offers a diverse set of markets. When it comes to spreads, Plus500 has a dynamic range of spread as compared to AvaTrade, which can go as low as 0.8 pip. AvaTrade also scored some points for supporting the MetaTrader MT4 and 5 platforms. Overall, AvaTrade emerged as the winning broker in this side-by-side comparson as it offers a suite of online trading platforms that come with a rich set of features integral to the growth of a trader.