Plus500 offers the majority of its services to its users for free. For the few transactions where fees are charged, it is all made transparent for users before they sign up for a trading account — in short, there are no hidden fees. The majority of Plus500 earnings comes from fees of bid and ask spreads, which are all based on internal monitoring. This section will let you understand more about Plus500 fees.

| Broker | Score | Minimum Deposit | Trade |

|---|---|---|---|

|

98 | $100 |

|

|

97 | $10 to $1000 (country-specific) |

77% of retail CFD accounts lose money |

|

94 | $5 |

74.89% of retail CFD accounts lose money |

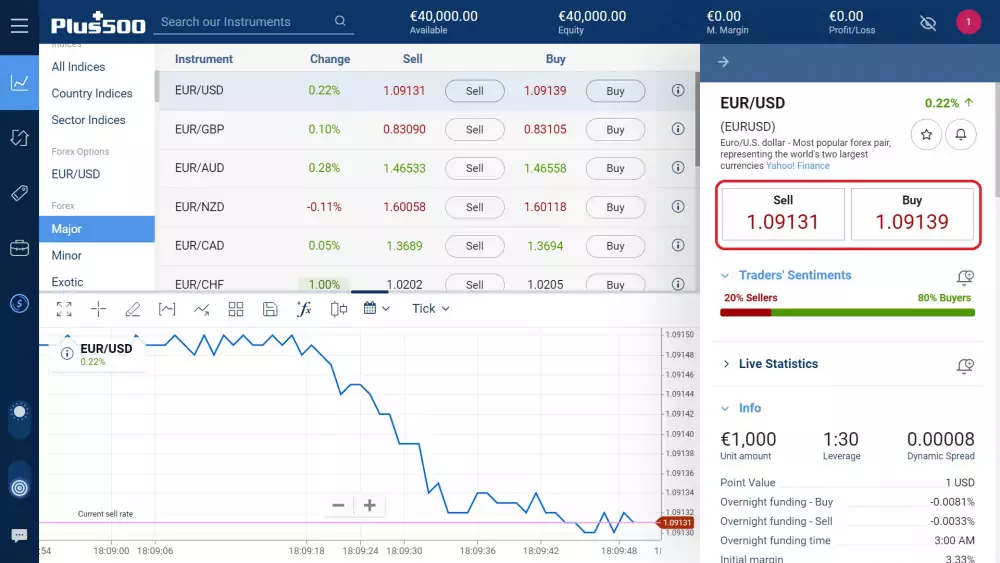

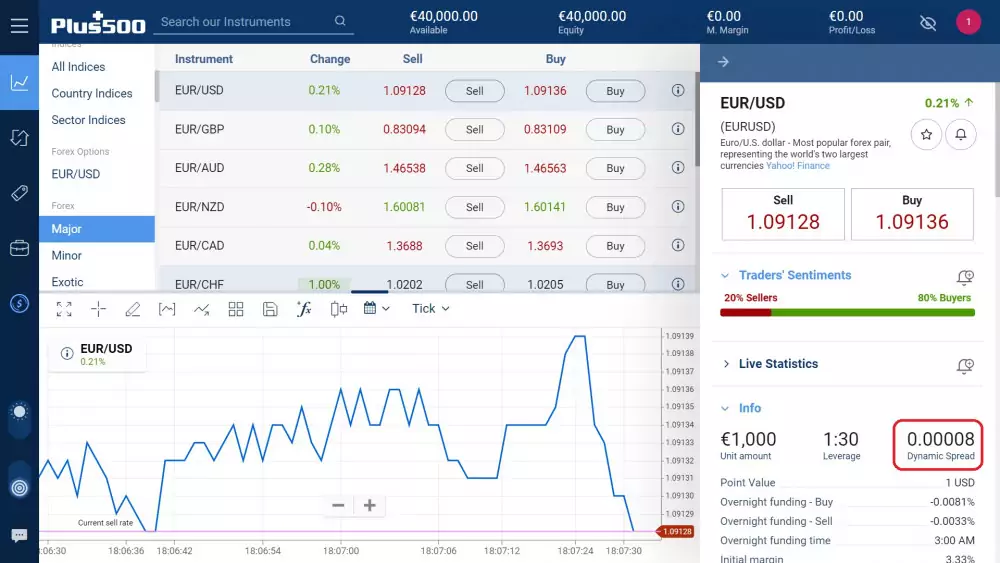

Plus500 earns compensation through the Bid/Ask (Buy/Sell) spread when a trader opens a position. Basically, a trader pays the spread and the amount of the spread is already included in the quoted rates of the financial instrument and is not an additional fee charged to Plus500 traders.

Spreads are calculated by subtracting the selling price from the buying price of the financial instrument.

Basically yes. A "spread" is the fee collected based on the difference between the buy / bid and the offer / sell price of a financial instrument. Simply said, a spread comprises only a very low percentage of amount added to the trading transaction.

Spread is defined as the difference between a "Buy/Bid" price and a "Sell/Offer" price at a specific moment in time.

For its instruments, Plus500 offers two spread mechanisms:

To view the spread of an asset or financial instrument you want to buy, simply follow these steps:

Here are the additional fees that Plus500 charges to its trader users:

No. Plus500 doesn't charge its users for any withdrawal or deposit transactions.

The fee for transferring money to your Plus500 account depends on your issuing bank and not on Plus500.

The "market spread" is the main method by which Plus500 is compensated. When trading EUR/USD for example with a buying rate of 1.14080, and a selling rate of 1.14084 (this means the market spread of 0.6 pips is payable by the trader to Plus500). Unlike other providers who charge commissions on every trade, Plus500 does not charge any trading commissions.

Plus500 does not charge trading fees when a trader engages in a contract-for-difference (CFD) trade. The only "fee" a trader will pay is the "spread" which is always included in the price of the financial instrument.

Plus500 doesn't charge any forex transaction fees. Again, the spread is already included in the forex buy price.