In trading with high leverage, it is very common to suffer financial losses even larger than your capital. However, with AvaTrade, you are safeguarded with their negative balance protection. This means it is impossible for you to lose money that exceeds your trading account funds.

In addition to this...

You can practice using a demo account for free before you invest real money. Most of the time, having control with leverage trading means knowing more the ins and outs of trading — including about leverage trading itself. This section will detail all you need to know about Avatrade leverage trading.

CFD traders sees "leverage" as a beneficial and powerful trading concept. Leverage help investors reach full potential of returns despite small price movements in the financial market. Leverage also help investors grow capital exponentially and inflate exposure to their chosen markets.

While leverage can help traders magnify profits when asset prices go in their favor, it can also hurt them when asset prices heads towards the opposite direction. Leverage allows traders to control a larger trade position in the market by putting down a 'small amount' of money. This is known as a “margin”.

Simply said, a leverage refers to the use of borrowed capital (or a debt) in order to open a trading position by increasing the value of an investor’s investment. In essence, a leverage is the ratio between the principal and the broker's investment.

Leverage works by taking advantage of the “margin” for traders to increase exposure to an underlying financial asset. Basically, with the help of leverage, traders put down a percentage of the over-all value of their trade — while your broker pitches in the rest in the form of a loan. This makes your total exposure to the asset as compared to your margin as the “leverage ratio”.

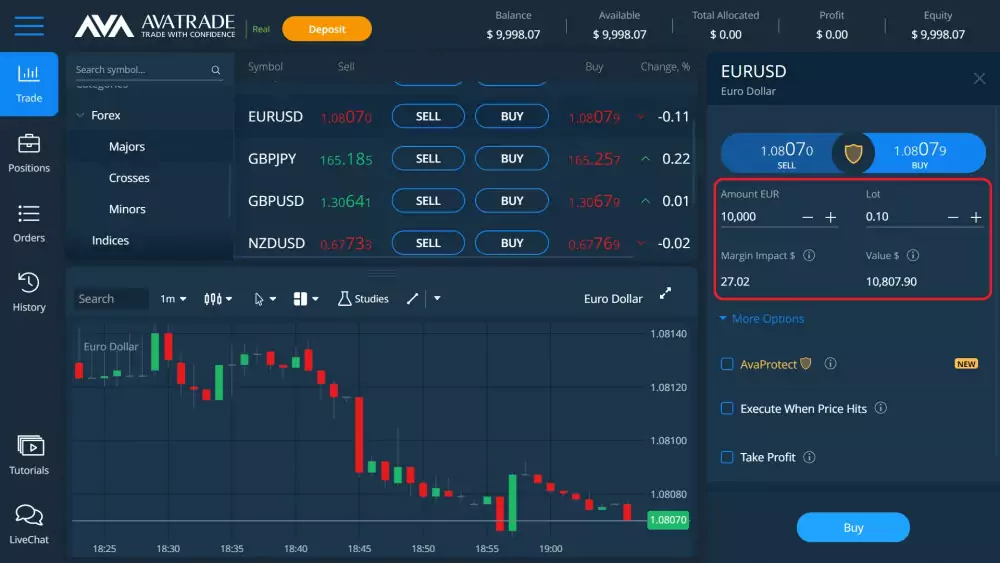

Here is a clear example of leverage using AvaTrade:

For starters...

Forex traders in AvaTrade can trade with a set leverage of as high as 400:1. Remember that this leverage can change depending on the asset class and jurisdiction a trader is trading in.

With a leverage of 400:1, a trader can open a $100,000 position in the market even with only $250 in their trading balance. This shows that even with the slightest change in the market of 1%, the trader can profit $1,000 (which is the 1% of $100,000) as opposed to earning a profit of only $2.5 (which is the 1% of $250) without leverage.

And take note:

While the example cited above showed how a leverage can magnify profits by the leverage value (in the example's case is 400), it can also multiply losses with the same number. This is why leverage is often referred to as a "double-edged sword" because it can magnify both profits and losses.

To maximize leveraged trading, it is important to know these advantages of leveraged trading:

Despite the many benefits of leverage trading, it also comes with its own disadvantages that every trader should watch out for.

Thanks to AvaTrade's 50% margin requirement, your account balance may suffer losses during a period of extreme market volatility, but it won't get completely dry up.

So what's the catch?

It is possible that any position can move quickly against your position that you may not have time to liquidate a position and keep your account from going negative. To keep this from happening, managing of leverage wisely is recommended.

Although both terms refer to borrowing money to open a trading position in financial markets, leverage is the act of borrowing, whereas margin refers to the amount that the trader has actually borrowed to invest.

In the case of leverage, it's the value of a position as compared to the investment amount needed (for instance, 100:1), while margin is the amount held by the broker to create the leverage, expressed as a percentage of the overall position.

A 100:1 leverage, for example, would allow you to control $100 of an asset with only $1 (1%) in margin.

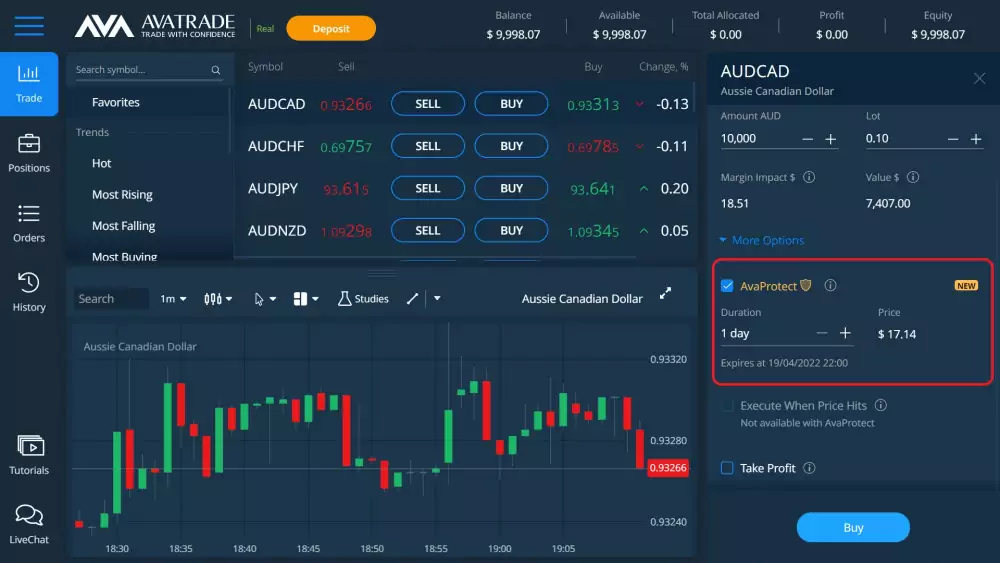

AvaProtect is AvaTrade's "Ultimate Risk Management Tool" feature that traders using the platform can utilize to allow them to claim their money on losing trading positions.

How can you actually use this?

It has a risk management feature that protect specific trades from losing up to $1,000,000 over a selected time frame.

Note: This feature is exclusive to users of selected AvaTrade platforms such as the AvaTradeGO app and WebTrader.