77% of retail CFD accounts lose money

Intro

eToro or Plus500? Which broker suits you the best? To find out, we've made a table of their essential features and left the decision to you.

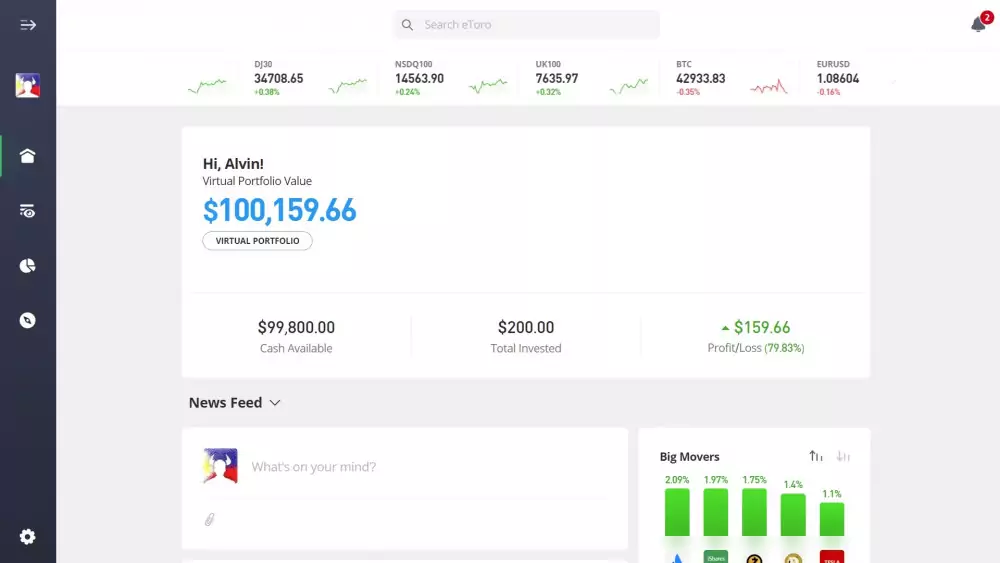

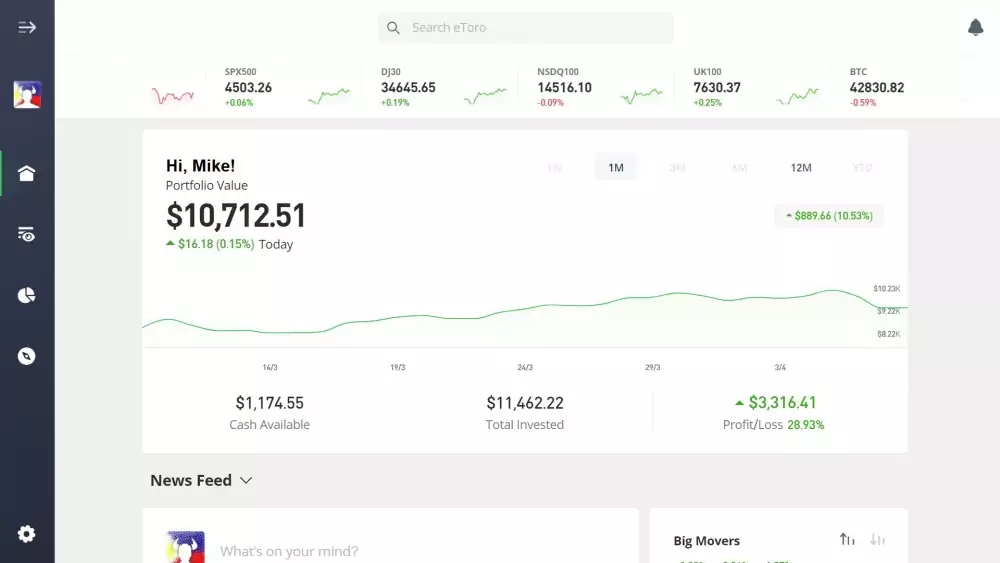

Both traders of eToro or Plus500 can test out the platforms and explore the features of each broker. If you're looking to try out one of these services, they offer demo accounts with no expiry date.

Here’s the thing: It may seem like you're only getting a free test, but for those new to trading it can help you learn and practice without risking your own money. Practice trading is a great way to see how the market works or what your trading strategies and decisions are like.

With practice, you’ll find it easier to make the right decision even in tough situations. You'll get access to all the features of the account so you’ll be more confident when you start trading with real money.

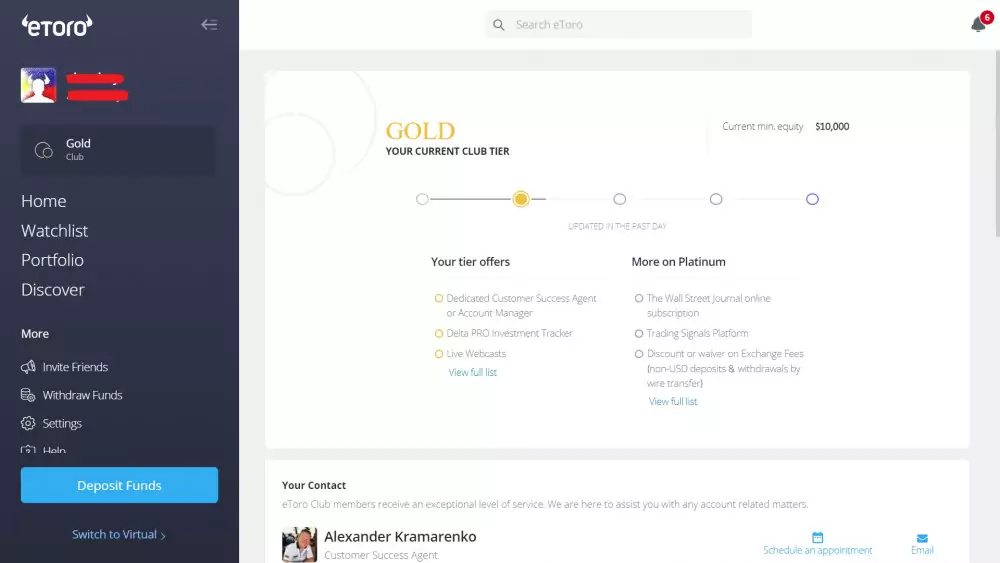

eToro has accounts for investors of all levels, including retail and professional accounts. Furthermore, there's an eToro Club where members get perks but this will vary depending on regulations and the language they're dealing with.

If eligible, your eToro Club membership will be automatically assigned to you based on the size of your equity. The following are the current club tiers:

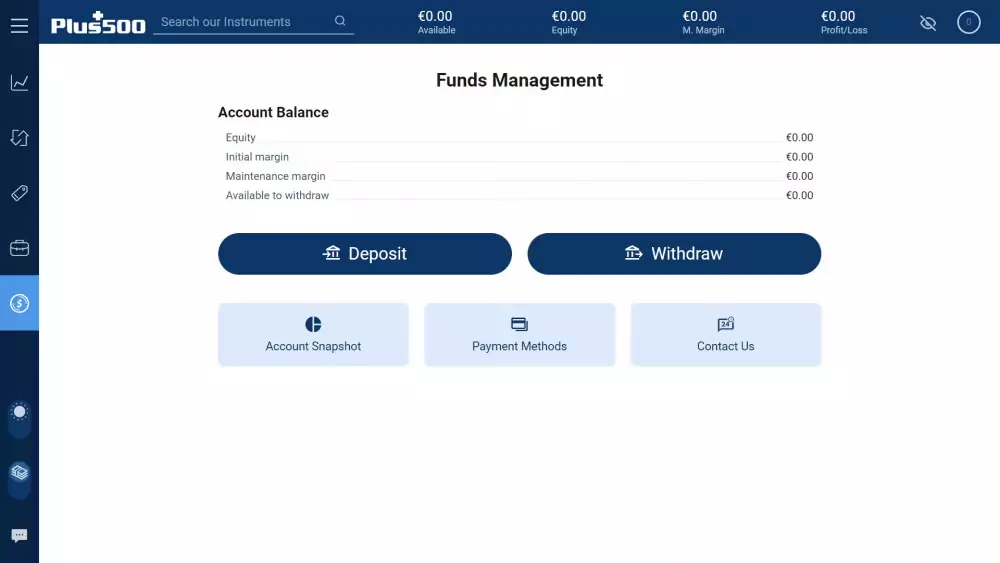

In comparison, Plus 500 does not offer enterprise accounts for businesses or account types in general. All individual accounts offer the same benefits whatever the size of your capital is.

Remember: You should always look for a broker that is regulated by a trusted regulator, such as FCA or CySEC. This helps to ensure they are operating legally and are trustworthy.

The good news? Both eToro and Plus500 are regulated.

As of this writing, Plus500 is regulated by the listed financial regulators:

eToro is currently licensed and regulated by the following:

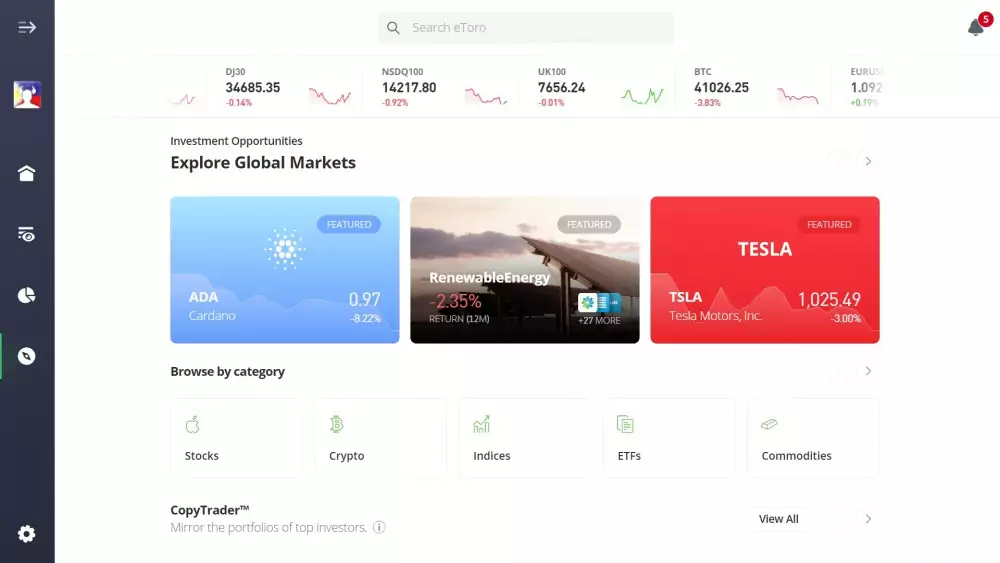

There are two platforms for eToro: mobile app or web-based, which can be accessed on any browser.

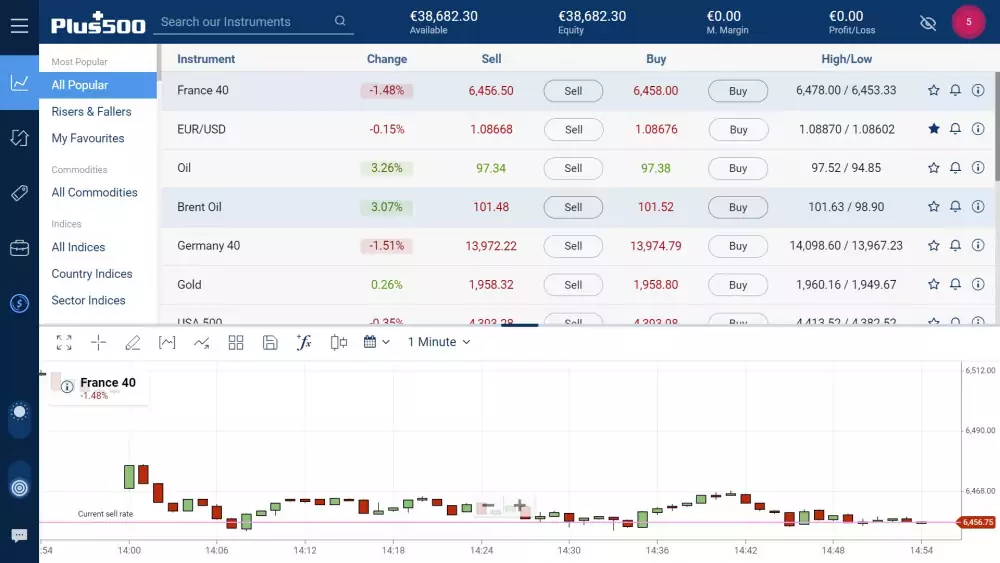

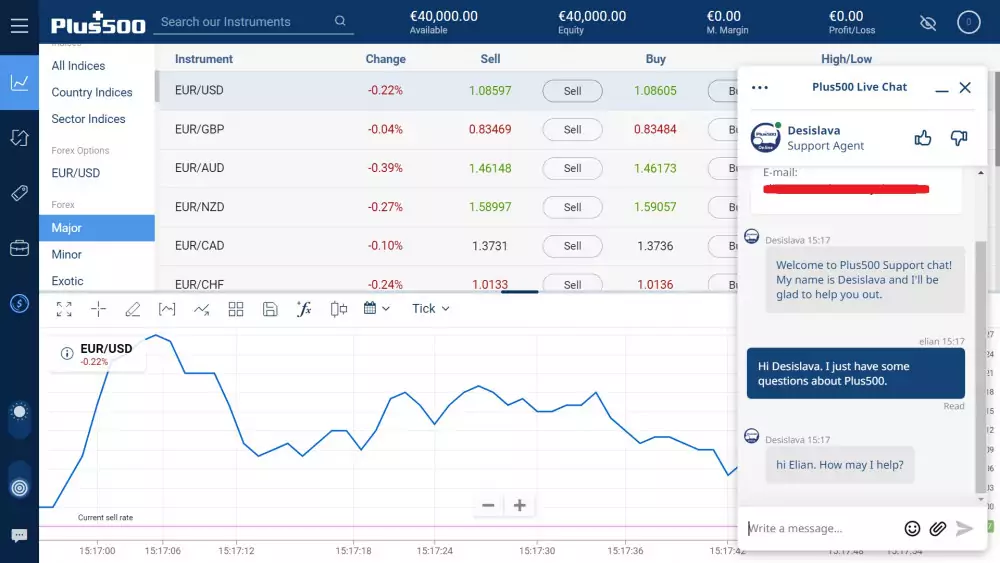

In comparison, Plus500 includes more offerings on their platform including the following:

Both brokerages provide different methods for their users to have access to their account and their portfolios. One is not necessarily better than the other, but a trader should always consider what method of access they are most comfortable with before making a decision.

eToro and Plus500 are just the very few popular CFD service providers today that have thousands of tradable assets. There are a lot of brokers out there, but most of them only allow you to trade a few hundred different types of instruments.

So what’s the deal?

This is not enough for those who want to become more involved in the market so Plus500 and eToro are definitely much better since they have 2000+ available options.

The number of tradable assets on eToro is 3000+, whereas Plus500 offers more than 2400. Brokers like these with more assets will give you access to different markets and therefore enable you to diversify your investments. You will also have a lot more control over what is on your portfolio.

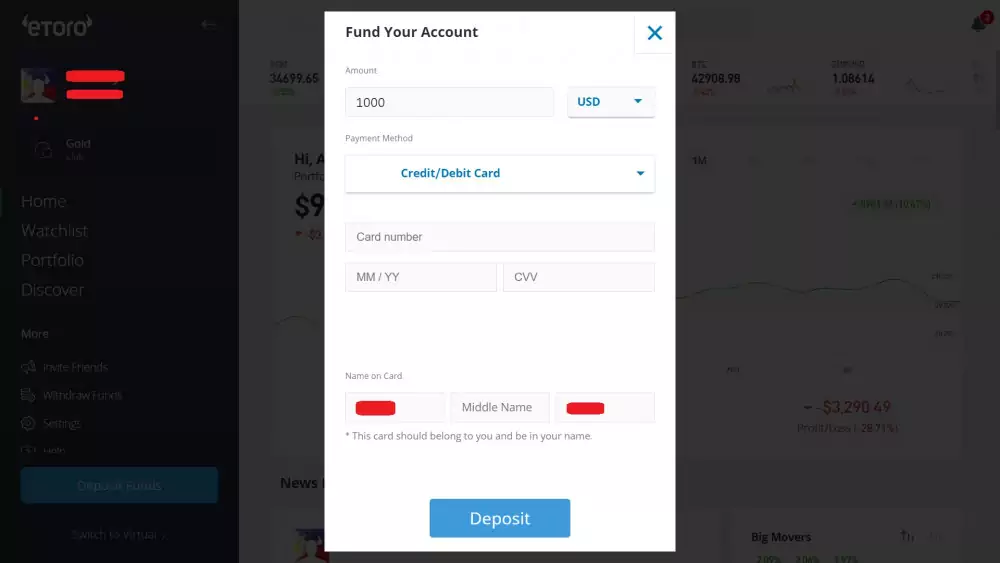

We like to say more is better. This is speaks mostly true when it comes to funding your trading account. You could deposit easily with your broker if they give you a lot of options.

In case your payment service provider has issues or decided to support funding online trading accounts, it would be helpful to have a broker that supports other funding options to avoid the hassle.

With eToro, traders can fund their account by using these options:

In comparison, Plus500 does not offer much when it comes to banking as it supports only the following:

With eToro, on average you can complete your withdrawal request in less than a day if you send the necessary documentation beforehand. Plus500 customers need an approximately 3 days.

In this category, eToro managed to score higher than Plus500 as they are able to handle withdrawals much faster than their competition.

You can get in touch with customer support via email and live chat. There is no phone support for both eToro and Plus500, but it’s worth mentioning that most brokerages have already stopped offering this method of communication because most businesses nowadays are done online.

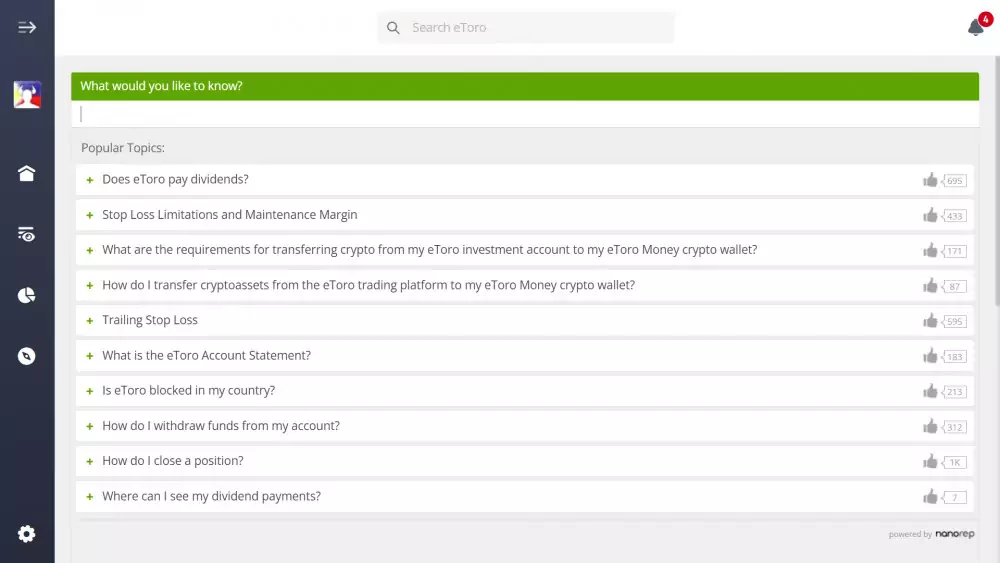

The difference lies on the other resources that their traders can use for self-help. eToro notably has a greater range of resources for anything related to the platform than Plus500, who only offer a simple FAQ page and information for their users.

eToro even has a Help Center that users can utilize for opening support tickets or accessing very detailed guides.

eToro and Plus500 are considered to be as good as any top brokerage, if not better. While they may have some features that are similar to others, they both stand out in certain aspects and provide a lot of great features that make them worth looking into. One thing that makes eToro more competitive over Plus500 is that it has a larger selection of assets. It also has a better choice of supported payment methods and offers its own Club with exclusive benefits. There are other differences too though; for example, Plus500 has more platforms available on their site. We would recommend going with eToro based on our comparison. Not only do they offer more, but their numbers are also better based on the table above.

77% of retail CFD accounts lose money