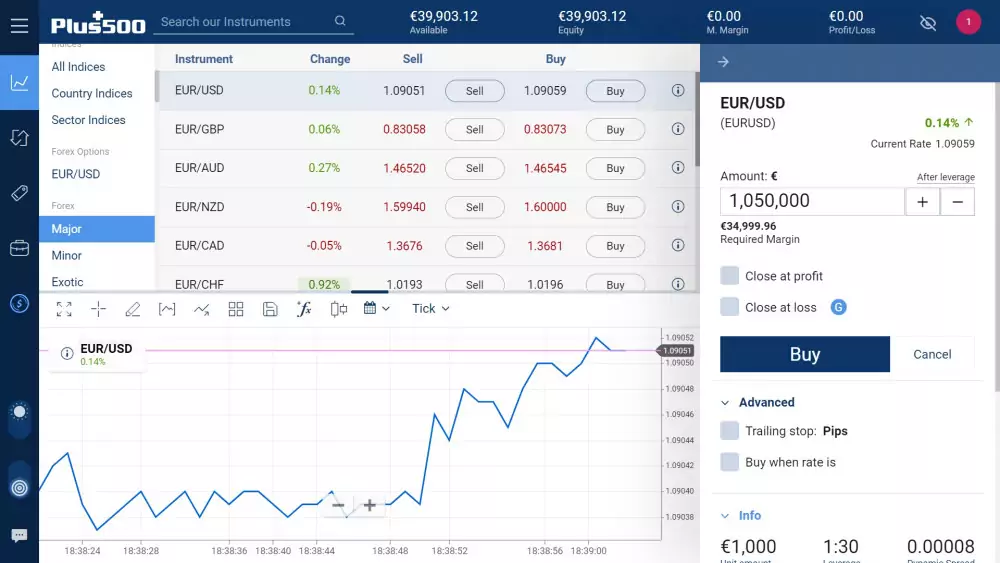

The Plus500 trading platform is one of the leading providers of CFDs (Contract-for-Difference) exchange services. By signing up for an account and using the Plus500 trading app, you can trade CFDs on cryptocurrencies (Availability subject to regulations - cryptocurrencies are not available to retail clients in the UK), indices, forex and shares.

| Broker | Score | Minimum Deposit | Trade |

|---|---|---|---|

|

98 | $100 |

|

|

97 | $10 to $1000 (country-specific) |

77% of retail CFD accounts lose money |

|

94 | $5 |

74.89% of retail CFD accounts lose money |

The platform offers capabilities that make life easier for traders such as easy monitoring of profits, trading with a leverage of up to 1:30, tight spreads and more plus features like risk management and trading analysis tools. The platform charges zero commissions while producing quick and reliable execution of trades. This section will cover all the topics related to the use, features and benefits of the Plus500 Trading platform.

CFDs or Contract for Difference are financial instrument products that enable customers to take advantage of all the features and benefits of holding stock, foreign exchange, ETF, index, option, or commodity positions without physically possessing the underlying instrument. When a trader purchases a CFD, the difference between the quoted price and the final price of the CFD becomes the amount to be settled, henceforth the term "Contract for Difference" or CFD.

Simply said: A CFD is a financial derivative that is closely regulated and observed by financial watchdogs. Traders enters into a contract with the CFD issuer when they Buy or Sell a CFD. The contract does not involve a purchase or sale of an asset, but rather traders potentially earn from the price movement of that asset.

The Plus500 Trading platform can be accessed on any device running on Android and Apple systems by downloading the Plus500 app on their smartphones, tablets or iPads. The platform can also be accessed using the WebTrader trading browser or the Windows 10 Trader on a desktop or laptop computer.

When using the platform for the first time, you must take note of these three most important tabs on the interface:

The Plus500 trading platform comes with both a demo account and a live account. The Demo account is the mirror image of the real-time trading platform. It is created for users to practice and develop their trading strategies. Traders — both beginners and experienced ones — can easily switch from the Demo account to the Live Account anytime they want.

Remember:

When making trades, make sure you are in the correct account since Plus500 cannot cancel or reverse a trade made in the Live Account that is supposed to be only tested on the Demo Account.

When using the Plus500 trading platform, you are introduced to a wide variety of financial instruments to choose from. Here are the following assets available to trade in the platform:

To familiarize yourself better with the Plus500 Trading platform, you will need to understand these basic trading terms