AvaTrade has established itself as a pioneer in the financial industry. One of its most distinctive features is spread betting, an intriguing form of trading that provides traders with the opportunity to profit from both rising and falling market prices. In this comprehensive guide, we'll delve into everything you need to know about spread betting with AvaTrade.

Spread betting is a derivative strategy, where participants do not own the underlying asset they bet on, such as a stock or commodity. Instead, spread bettors speculate on whether the asset's price will rise or fall, where the degree of change is the main determinant of profit and loss.

Spread betting is also marked by its unique tax benefits. In certain jurisdictions, profits from spread betting do not attract capital gains tax. This tax-free nature of spread betting makes it a powerful tool in the hands of informed traders.

Both spread betting and contracts for difference (CFDs) are popular financial derivatives that allow traders to profit from price movements in underlying markets, such as forex, indices, commodities, and more. While they share similarities, there are fundamental differences between these two trading mechanisms that are essential to understand for every trader.

Spread Betting is a form of derivatives trading where traders speculate on the price movements of various financial markets. In this form of betting, you don't own the underlying asset; instead, you bet on whether the price of the asset will rise or fall.

Contracts for Difference (CFDs), on the other hand, are derivative products that enable traders to speculate on the rising and falling prices of fast-moving global financial markets (or instruments) such as shares, indices, commodities, currencies, and treasuries.

Ownership of the Underlying Asset: In both spread betting and CFD trading, you don't physically own the underlying asset. Instead, you're speculating on the price movements. However, with CFDs, you're trading a contract (the CFD), which mirrors the price and performance of the underlying asset, making it feel more like traditional trading.

Taxation: One of the main differences between spread betting and CFD trading lies in their tax implications. In certain regions, spread betting is considered a form of gambling, thus it's exempt from Capital Gains Tax (CGT) and Stamp Duty. CFDs, however, are not exempt from CGT. It's important to note that tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Profit and Loss Calculations: Profit and loss in spread betting are calculated based on the stake size multiplied by the amount the market moves in your favour or against you. For CFDs, profit and loss are calculated based on the number of contracts and the level of movement in the price of the asset.

Currency of Trading: Spread betting is typically conducted in your local currency per point movement. Conversely, CFDs are traded in the currency in which the underlying asset is denominated.

Trading Costs: Spread betting costs are included in the bet, so you are aware of all costs before the bet is placed. However, with CFDs, there may be various additional costs, such as commission fees, transaction fees, and overnight holding costs.

Determining whether spread betting or CFDs are right for you depends on several factors, such as your risk tolerance, financial goals, and understanding of the markets.

Spread betting might be more suitable for those who prefer a straightforward approach, with profits and losses easily calculable, prefer their transactions to be in their local currency, or who might benefit from the tax implications.

On the other hand...

CFDs might appeal to those who prefer a trading experience that closely mirrors traditional trading, are trading in large volumes (where commission-based pricing could be advantageous), or want to hedge an existing portfolio, as CFD losses can be offset against profits for tax calculation.

AvaTrade offers a robust platform for spread betting. Their innovative model is designed to cater to both novices and experienced traders. It revolves around a bid-ask spread, which is the difference between the price at which you can buy an asset and the price at which you can sell it.

When spread betting, you place a bet per unit of movement in the particular asset's price. If you believe the asset's price will rise, you 'go long' or buy. If you predict the price will fall, you 'go short' or sell.

Let's use a simple illustration to comprehend this better. Suppose AvaTrade quotes a bid and ask price for a particular asset, say, a stock priced at £100 and £102 respectively. If you believe that the stock price will rise, you may 'go long' at the asking price of £102. If the stock price ascends to £105, you will gain £3 for every point that you have bet. If the stock price drops to £98, you will lose £4 for each point bet. Conversely, if you decided to 'go short' at the bid price of £100 and the price drops to £97, you gain £3 for each point bet. However, if the price rises to £103, you lose £3 for each point bet.

There are several reasons why AvaTrade stands out as an ideal platform for spread betting.

Regulation and Trust: AvaTrade is a regulated broker across five continents, providing users with peace of mind. It adheres to the strictest of standards, ensuring safety and security for traders.

Intuitive Trading Platforms: AvaTrade provides cutting-edge platforms that are user-friendly, reliable, and packed with tools for in-depth market analysis. This allows you to make informed decisions and get the most out of your spread betting experience.

Comprehensive Education and Support: AvaTrade is dedicated to empowering its traders. They offer comprehensive educational resources that help traders understand the markets and the nuances of spread betting. Their dedicated customer support is always ready to assist you, addressing any questions or concerns that may arise.

Competitive Spreads: AvaTrade is known for its competitive spreads that allow you to maximize your potential profits. The spreads can be as low as 0.8 pips, which is highly advantageous for spread bettors.

Advanced Risk Management Tools: Spread betting is exciting but can be risky. AvaTrade equips its users with advanced risk management tools to control potential losses. This includes features like Stop Loss, Take Profit, and entry orders.

Please be aware that AvaTrade exclusively offers spread betting to its clients residing in Ireland and the UK only. This financial strategy is particularly appealing to traders due to its notable tax benefits. Unlike other financial market investments, the profits derived from spread betting are exempt from capital gains tax and stamp duty, thus presenting an attractive incentive for investors.

Spread betting is readily accessible across a diverse array of financial instruments via the globally renowned MetaTrader4 (MT4) and MetaTrader5 (MT5) trading platforms, which AvaTrade offers. This award-winning platform enables you to reap the benefits of tax-free profits, swift trade execution, robust analytical tools, live dynamic trading charts, and competitive spreads.

Furthermore, MetaTrader boasts an expansive portfolio of financial instruments. You have the flexibility to select from over 200 assets encompassing forex, stocks, indices, commodities, and ETFs. A unique feature of MT4 and MT5 is the Guardian Angel risk management tool, which provides customized feedback on your trading performance to enhance your investment strategies.

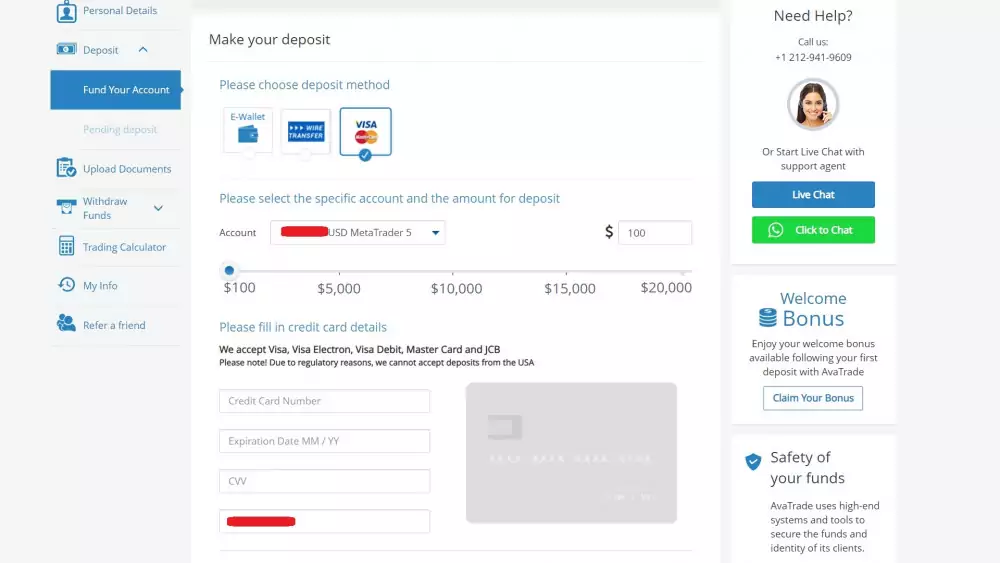

The process of beginning your spread betting journey with AvaTrade is straightforward and convenient. You need to follow these basic steps:

AvaTrade believes in empowering its traders with knowledge. Hence, they provide a range of resources to enhance your understanding and skills in spread betting.

Spread betting with AvaTrade offers a plethora of opportunities. It is a thrilling way to speculate on various financial markets. AvaTrade, with its state-of-the-art trading platform, extensive educational resources, and committed customer support, provides a conducive environment for spread betting.

Remember: While spread betting can lead to significant profits, it also comes with potential risks. Hence, it is crucial to understand the concept thoroughly and use risk management tools effectively. Take advantage of AvaTrade's resources and start your spread betting journey today!