Bitcoin (and cryptocurrencies in general) are growing in popularity and it's been on the rise for more than a decade so trading opportunities abound. Plenty of information and resources are available here to help you start investing in this exciting investment opportunity!

So, are you new to the whole Bitcoin trading thing and want to know more? Keep reading for more detailed information before you start to invest in such a volatile market.

The crypto market never sleeps. It is a 24/7 operation and it changes every second. It can be difficult to keep up with the rapid changes in prices and volume of the cryptocurrency market so it is important for you to know its real-time price.

Today, Bitcoin has a market capitalization of

Here's a breakdown of every important statistic that you need to know about this highly volatile cryptocurrency.

Bitcoin's market cap has seen a significant increase by the year 2017. It managed to reach an all-time high of 1156.49 billion US dollars on October 2021.

The crypto market is extremely volatile and it's not uncommon to see a 20% change in price in a day. Since January 2021, Bitcoin reached a volatility peak rate of 128.07% and this happened on May 24, 2021. It's lowest rate was 11.62% which happened on February 1, 2022.

BTC's market dominance was at its peak on February 2017 with a rate of 95.68%, while altcoins only had a share of 4.32% during this month.

In 2021, Tesla made headlines when the company announced that it has bought $1.5 billion worth of Bitcoin. While this is quite a big news, software company MicroStrategy currently holds the highest number of BTC holdings for a public company.

Listed below are public companies with the largest Bitcoin (BTC) holdings in the world:

| Company | BTC Units Purchased |

|---|---|

| MicroStrategy inc. (U.S.) | 91,850 |

| Tesla, Inc. (U.S.) | 43,200 |

| Square inc. (U.S.) | 8,027 |

| Marathon Digital Holdings (U.S.) | 5,425 |

| Coinbase Global, Inc. (U.S.) | 4,487 |

| Galaxy Digital Holdings (Canada) | 4,000 |

| Bitcoin Group SE (Germany) | 4,000 |

| Hut 8 Mining Corp (Canada) | 3,233 |

| NEXON Co. Ltd (U.S.) | 1,717 |

| Riot Blockchain, Inc. (U.S.) | 1,565 |

| Voyager Digital LTD (Canada) | 1,239 |

| Seetee AS (Norway) | 1,170 |

| Meitu (Hong Kong CAR) | 941 |

| Argo Blockchain PLC (U.S.) | 927 |

| Bitfarms Limited (Canada) | 650 |

There were only 1.3 million Bitcoins circulating in the market on October 2009. By September 2012, more than 10 million BTCs are already in circulation worldwide and as of March 2022, it has now reached 19 million. That means there are only 2 million BTCs left that are not yet circulated in the market.

The USA, China and Kazakhstan are currently the top 3 countries where most Bitcoin mining occurred. These figures are based on where most of the hashing and consequently, Bitcoin mining, occurs. Please keep in mind that BTC mining figures are not equivalent to Bitcoin trading figures.

Bitcoin was invented by an unknown programmer, or a group of programmers, under the name Satoshi Nakamoto and released as open-source software in 2009.

The system is peer-to-peer, and transactions take place between users directly, without an intermediary. These transactions are verified by network nodes and recorded in a public distributed ledger called the blockchain. Bitcoin was invented after decades of research into cryptography by software developers.

The first Bitcoin specification and proof of concept was published in 2009 in a cryptography mailing list by Satoshi Nakamoto. The recipient of the first Bitcoin transaction was cypherpunk Hal Finney who used to work at Intel.

There are different ways or methods to invest in this cryptocurrency and this would depend on your risk appetite:

There are brokerages that will offer you the opportunity to buy real BTC from their platform.

The process is fairly simple and is the same as exchanging one currency to another and the only difference in this case is that you are exchanging fiat currency (e.g. US or GBP) to BTC.

Once you have bought a specific unit of BTC, the value of the crypto asset needs to go higher in order for you to make a profit.

For example:

You bought BTC while it's value was $28950. In order for you to make a profit, the value needs to appreciate and must go higher than $28950. If BTC's value goes down, you incur a loss. However, you have the choice of holding your tokens if you expect that it's value will still go up in the future. The term that most crypto traders use for this is HODL or "hold on for dear life".

With Bitcoin CFDs, you have the choice of going short or long, depending on how you expect the value of BTC will be.

In addition, trading CFDs won't require you to have an account from an exchange or even a crypto wallet since you're basically speculating on BTC's price movement.

As compared to buying BTC, with CFDs, you don't own the crypto asset because your profits or losses are primarily based on Bitcoin's value going upward or downward. And even if the price is going up or down, there's an opportunity to make a profit as long as you placed the right position.

As an added bonus, we've conducted a thorough investigation to find the best brokerages that provide Bitcoin trading. They all have secure platforms and excellent trading conditions.

Aside from this, we've only tested those that currently have active licenses from well-known financial regulators such as the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission, and the Cyprus Securities and Exchange Commission (CySEC).

Why is this is important?

A brokerage that is licensed and regulated is capable of providing you a much more secure and reliable environment for trading cryptocurrencies like Bitcoin.

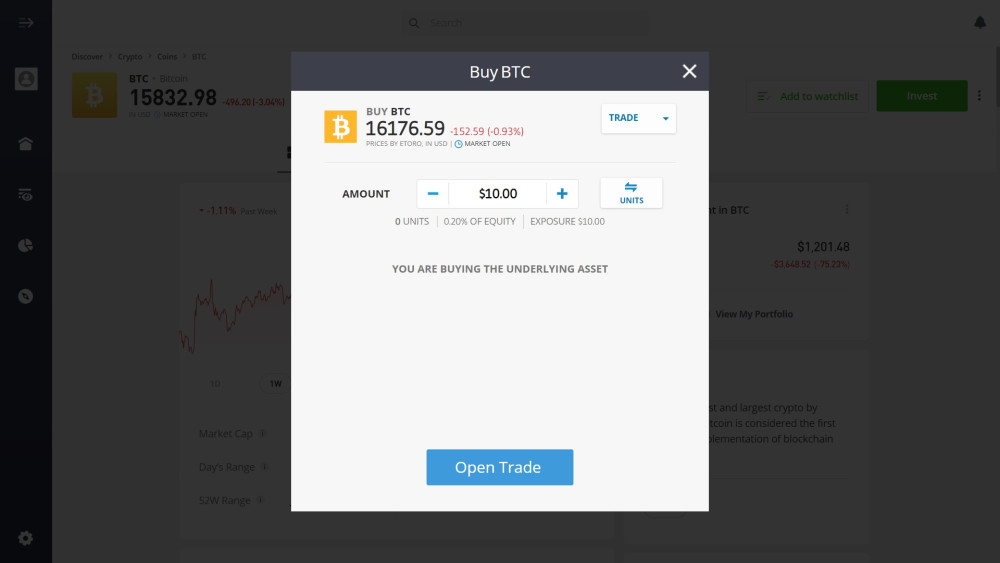

eToro is multi-asset brokerage company that features a social trading platform where you have the choice of buying real Bitcoin or trade Bitcoin CFDs. Minimum deposits start at $10 (US & UK) and the minimum investment is only $10 for crypto assets like BTC.

AvaTrade is a multi-regulated brokerage firm that offers competitive conditions for crypto assets like Bitcoin. You can go long or short on their trading platform and enjoy ultra-low spreads.

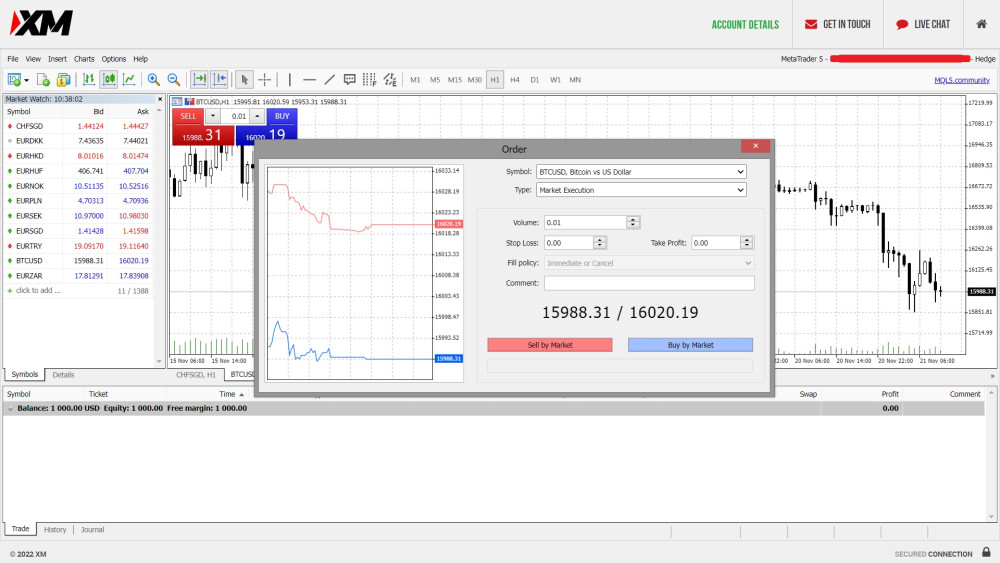

BTCUSD is offered by XM as a cash CFD. These are undated transactions that have also been adjusted for interest and are based on the cash value of the underlying crypto asset.

Here's the story:

We've done a comprehensive research and tests on these brokers that provide Bitcoin trading. And best on these tests, we were able to come up with this list of brands that we recommend:

Now that you have all this information about Bitcoin, it's the perfect time to register with one of these highly recommended brokerages. Be sure to open an account only with a licensed broker.