eToro charges zero-commission and no management fees on transactions made on the platform. This means no broker fee will be applied when opening or closing a trade position. However, fees are applied on other transactions such as forex exchange and overnight holding fees for other financial assets. eToro also charges fees on some withdrawals and various spreads. To learn more about eToro fees, here is a brief section to explain about it.

An overnight fee is a payment that you must make if you hold a position overnight.

Similar to the value of the position, CFD positions that stay open overnight generate a small amount of fee. These fees are made to reflect the forces of supply and demand influencing the financial markets and to cover the costs related with your position.

The fee varies depending on whether the position is bought or sold. A refund may be possible overnight in some cases.

Here's the thing: Rollover fees is the same as overnight fees thus it is usually referred to as “Overnight / Rollover fees”.

Here is a sample computation of overnight / rollover fee:

(Overnight fees (per night): Fee * number of units)

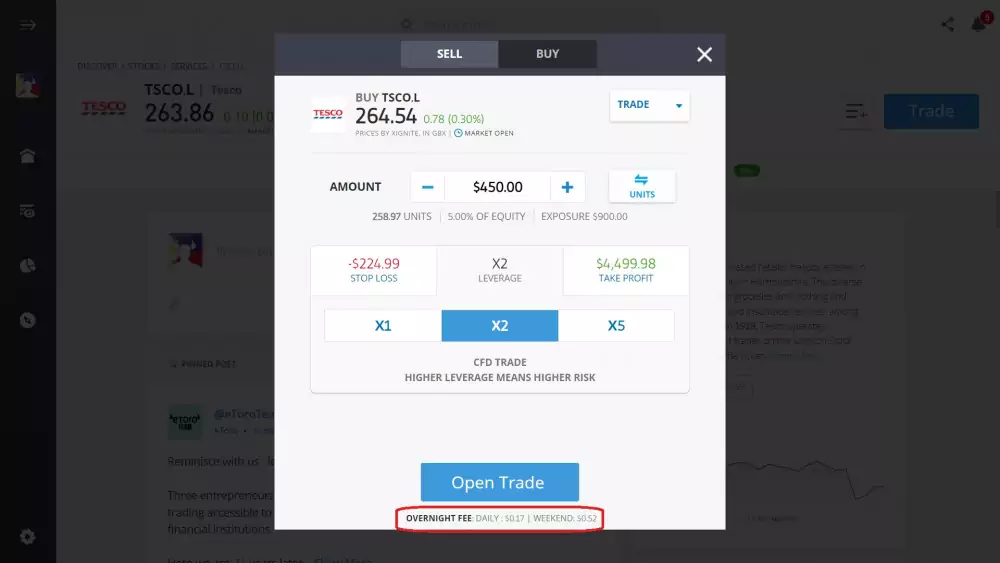

When you're at the trading page of an asset, you will see the "overnight fees" appearing at the bottom of the trade window just under the "Set Order" box.

Since most of eToro's compensation comes from spreads, this is where much of the platform's fees are concentrated. Here is a sample computation of spread in eToro:

Spread: (Spread * Price in USD * Number of units)

Spread will immediately reflect after you open a trade, you will see a "loss" in the position. The spread is responsible for that “loss”. Although the final calculation of the spread doesn’t take place until the position is closed. The spread is then adjusted basing on the closing price in real-time.

You can keep track of the fees you paid by going to your portfolio page in the platform. From there, click the "history" tab to see the fees incurred for each trade and your other fees made in different periods of time.

Overnight or rollover fees are charged every night from Monday to Friday. It is usually at 5:00 P EST for all open CFD positions. The weekend fee (also part of overnight fee) is charged on Friday nights for most ETFs, CFDs, stocks and Indices and on Wednesday night for currencies and commodities. Overnight fees for natural gas and oil are also charged every Friday.

Cryptocurrencies meanwhile, incur overnight fees daily.

Once eToro fees are charged when your account balance is not enough, it will then reflect a negative balance.

No. The "Bid" and "Ask" signify the "Buy" and "Sell" prices of financial assets on eToro. When a trade position is long / BUY, the "Ask" rate is then applied. But when the position is short / SELL, a "Bid" rate is generated.

No. LIBOR is not an exclusive eToro fee. LIBOR is the benchmark rate given by banks when imposing a charge on other banks for short-term loan. It stands for "London Interbank Offered Rate". Other banks and trading platforms also incur a LIBOR fee for their users.

There are 35 varying LIBOR rates posted daily. This ranges from overnight to a year and based on 5 currencies. eToro is using the one-month US dollar LIBOR rate when computing for overnight fees on stocks.

eToro charges $10 every month for accounts that are inactive for at least a year. It's actually very easy to avoid getting this charge since you'll only need to access your account every now and then so that it won't be dormant.

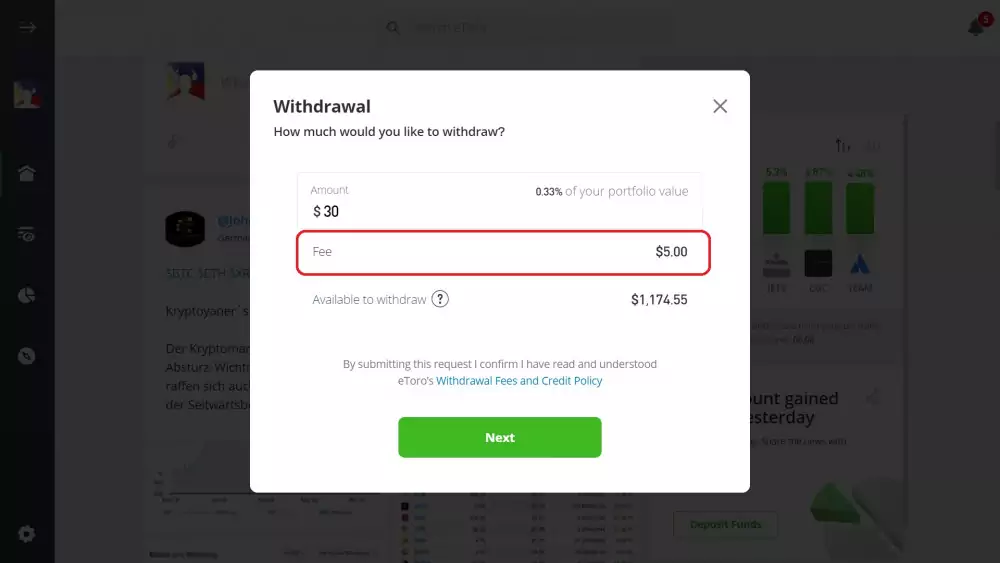

For every withdrawal, there is a $5 fee to pay and the allowed minimum amount that can be taken out from the account is $30. This is a flat fee so whatever amount you wish to withdraw, you will only be charged with $5 for each transaction.

Since much of eToro’s transactions are in USD, there are no fees associated with USD deposits.

Deposits can also be made in 14 other currencies: EUR, AUD, VND, RMB, GBP, THB, SEK, IDR, MYR, PHP, DKK, NOK, PLN, CZK.

And it's important to remember: A conversion fee is charged when converting the funds to USD.

During the Deposit Funds process, you can see the amount of your payment in USD as well as the conversion rate prior to sending it in.